By reading it, I found out that the contents are very common, and it's a bit similar to "The Millionaire Next Door". Well, it doesn't matter, I've no complaint since I read it for free. As usual, I would like to share with you some of the vital points from this little thin book. If you think you are interested about it, then you can buy and read it at your own. :)

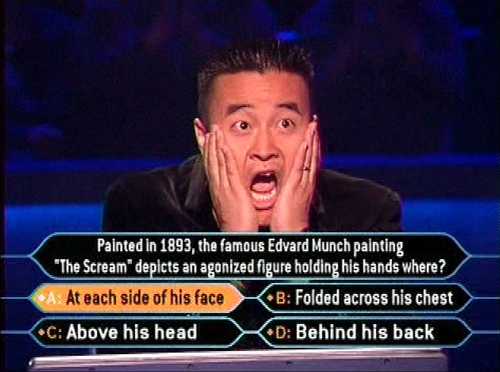

Have you watch "Who wants to be millionaire" before?

a) Thinking day to day, the way poor people do, is where you will find day laborers and street beggars.

b) Thinking week to week, the way poor people do, is living paycheck to paycheck and barely make ends meet.

c) Thinking month to month, the way middle class people do, is being concerned with monthly liabilities such as mortgage loan, car loan, credit card payment and household expenses.

d) Thinking year to year, the way rich people do, is where people learn about fiscal responsibility, financial literacy and investment.

e) Thinking decade to decade, the way very rich people do, is where you will find business plans that reach far into the future.

2. Patience is a millionaire’s asset; impatience is a liability of the middle class:

a) Rich people has the discipline of delayed gratification because they want more freedom in life.

b) Middle-class people want instant gratification because they want more comfort in life.

3. Millionaires talk about ideas:

a) Rich people talk about great ideas and realizing them. They own car companies, sports teams and vacation spots. They produce movies, television shows and music and earn from them. They choose fortune over fame.

b) Middle-class people talk about things from rich people’s ideas and daydream on them. They talk about things like sports cars, soccer teams and holidays. They indulge in movies, television shows and music and spend on them. They are easily impressed by fame.

4. The rich loves to compliment others and gain their help and support; the poor loves to tear down others only to be alienated.

5. People who complain are literally cursing themselves. Always ask yourself what is life trying to teach you when you feel like complaining upon a challenge or hardship.

When we talk about Millionaire, people will think of Slumdog Millionaire.

7. Fear is inevitable. The rich overcomes it with knowledge; the poor submits to it with negligence.

8. If you can live with the worst thing happening from your decision and the most likely thing to happen will lead you to the best thing happening, go for it!

9. We can’t please everyone and rejection is imminent; if you failed, you may be rejected but if you succeeded, you may still be rejected.

10. The rich plays to win; the poor plays to not lose only to lose in eventuality.

11. People often wish they would take more risks in life if they could live all over again, meaning that people have more regrets over things they didn’t do than the things they did.

Entrepreneur should be the most solid way of becoming millionaire.

a) Investment on a $20 book read may well worth a $20 000 idea and a $1 000 seminar attended may well worth a $1 million business plan.

b) Being penny-wise and pound-foolish by saving a $50 banknote for shopping instead of buying a good book may cost a loss of an undiscovered $50 000 idea. Worst off, craving for free advices may cost even greater loss when one listens to the opinion of another who thinks he knows something even when he has no real life experience.

13. The rich work for profits instead of wages; the poor trades their time for wages.

14. Happy millionaires are generous because they believe they will receive more in return.

15. Millionaires develop multiple income source by passive income from business that requires little personal management. They build teams of great people that complement one another, not compete with one another, to run their business, believing that those people will do even better than them.

16. Learn to increase your net worth the way rich people do, not learning to increase your paycheck only to be taxed more.

17. Rich people increase their investment and assets when their income increases; poor people increase their spending and liabilities as their income increases.

18. The rich makes money, spends money, then pay taxes; the poor makes money, pay their tax and left with little to spend.

So, are you already a millionaire or multi-millionaire? If yes, you might reading some of the characteristics from yourself. For those who are not, may be you can try to buy jackpot, if you are thinking of become an instant millionaire.

All the best.