I'm not sure about you, my priority is based on:

1) Rebate/Reward

2) Easy to make payment

3) Security

4) Annual fees waiver

My 1st priority is based on rebate/reward, because I want focus on my savings, as I did spend quite some money on credit card monthly. Easy to make payment also indirectly leads to petrol and time savings, especially those offer online payment and bank which nearby my office/house. Security is the major concern of credit card users nowadays, I believe you have heard many cases of credit card fraud, which is unavoidable. Your credit card limit might be abused easily if the bank operator does not contact you on time. And lastly, annual fees waiver also one of the favorite of most credit card users nowadays.

I have did some online research over some major banks in KK listed below.

HSBC, Standard Chartered, Hong Leong, Citibank, Maybank, Eon Bank, Public Bank, United Overseas, Ambank, CIMB

After the research, it seems like Shell Citibank credit card sound most attractive for me. Hey it's about 5% rebate on Shell fuels and 1.5% rebate on retails spending! You cannot find such a good rebate rate in any other bank in Malaysia. I was so excited. We have always heard, 'there is no free lunch in this world'. So I decided to make it clear and check about this benefits further. Yes, no free lunch, people. To obtain the rebate, you must have a carry forward balance, that you have to pay Citibank 18% interest per annum. And the so called rebate is based on your current month spending. This means, if you have a carry forward of RM5,000 but you did not use the card at all for the current month, you enjoy 0% rebate. You can refer the details in the table below:

| ||||||||||||

|

This is not a big deal, this is only one of the marketing strategies, it's relatively okay. We just need to make sure we are smart consumers and don't make immediate decision when see this kind of 'free lunch'.

Okay, I found out few more banks offering cash rebates here, we are no longer looking for carried forward balance thingy. They are UOB, Public & CIMB Bank. UOB seems a lot more interested because it is an international bank with better card security offer. They willing to call you whenever your card is used elsewhere or online! Yes there is a testimony here. For local bank, sorry la, you call yourself okay.

Nice Card Design

Nice Card Design

A ugly card design

A ugly card design

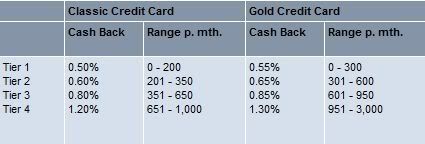

For Public Bank, it did offer some rebates based on how much you spend annually, which is better than none. PBB rebate offers play as below:

Meaning, if you spent RM10,000 over the last 12 months, you will entitled for RM50 cash rebate. It looks like not a big deal, but better than none right, you also gain your reward point at the same time. There is another good thing, you are entitled to apply GOLD card by only gaining annual income of RM25,000, no kidding, please refer to the card requirement. Happy or not?

For CIMB Bank, a new card was introduce early of this year, CIMB Petronas MasterCard. It's a lot more interesting than PBB, because it offering the following 'real' benefits:

1) Free for Life, without any term and condition!

2) 2% rebate on Petronas Service Station

3) 0.5% rebate on other retail transaction

Besides, it requires only RM30,000 income per annum to apply for a gold card.

Petronas Card launched by CIMB together with Maybank

Most of the time, you can just wait until there is special promotion or good offer from the bank like free gift and free for life etc. Or you can just apply one for temporary first, and cancel it later on, re-apply the one you like, no cost involves since it is totally free, except your precious time.

Credit card did bring convenient and benefits, but please always remember to use and repay your credit card wisely.

4 comments:

Hey, want to introduce you also CIMB PETRONAS Credit Card to you all. Apart from 2% rebate from Petronas petrol station, you also entitled 0.5% rebate for retail transaction. Another good point is, it's FREE FOR LIFE, without any term and condition. And you only need RM30,000 annual income to apply a Gold card. The only limitations are, CIMB online system is not as comprehensive as Maybank, and only Mastercard is available at this moment. Cheers.

Ki Siao! I think start from tomorrow onwards, every Ta Kung Zai will very need the 2% rebate!!!

Thanks for sharing. I had just applied for Direct Access CIMB credit card. It is offering 2% rebate at any petrol stations nationwide. Furthermore this FREE for life card has all the same benefits as a CIMB credit card. It is also offering RM50 cash for introducing new cardmembers. So if you want to apply, please drop me an email for the application form. :)

If you want to get even more savings, you could pump at Shell and swipe your Bonus link card. Bonus link has the most comprehensive rewards list and excellent delivery time for your redemptions.

Thanks.

My friend told me that he just applied RHB credit card, also offering 2% cash rebate monthly from any petrol station. I think more banks to come about this. Good for us.

Post a Comment